Accumulated depreciation formula balance sheet

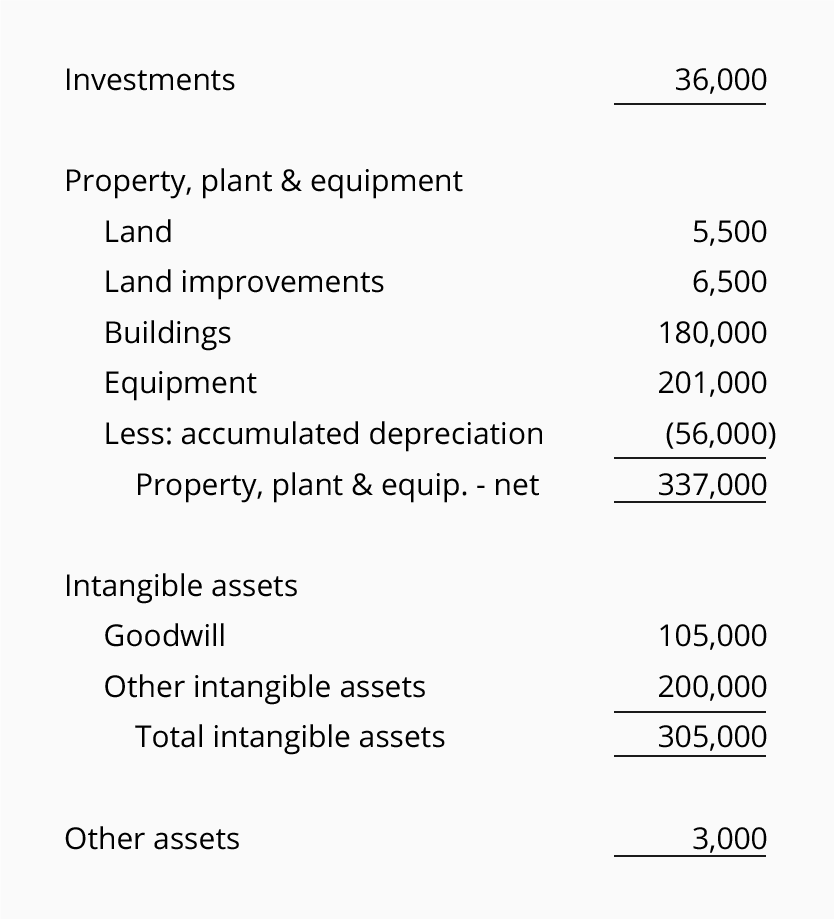

Operating income Net Earnings Interest Expense Taxes. When we add the balances of these two assets we will get the net book value or carrying value of the assets having a debit balance.

Accumulated Depreciation Explained Bench Accounting

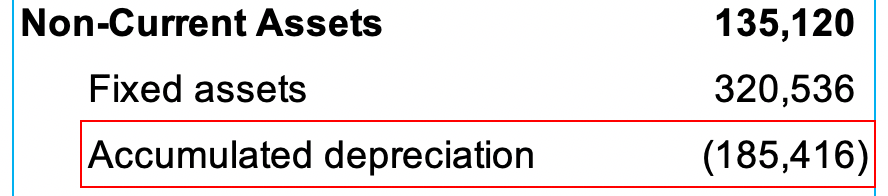

Accumulated depreciation is the contra asset account Contra Asset Account A contra asset account is an asset account with a credit balance related to one of the assets with a debit balance.

. Accumulated depreciation refers to the total amount of depreciation for an asset that has been recorded on a companys income statements. Assets Liabilities Equity. It can also be referred to as a statement of net worth or a statement of financial position.

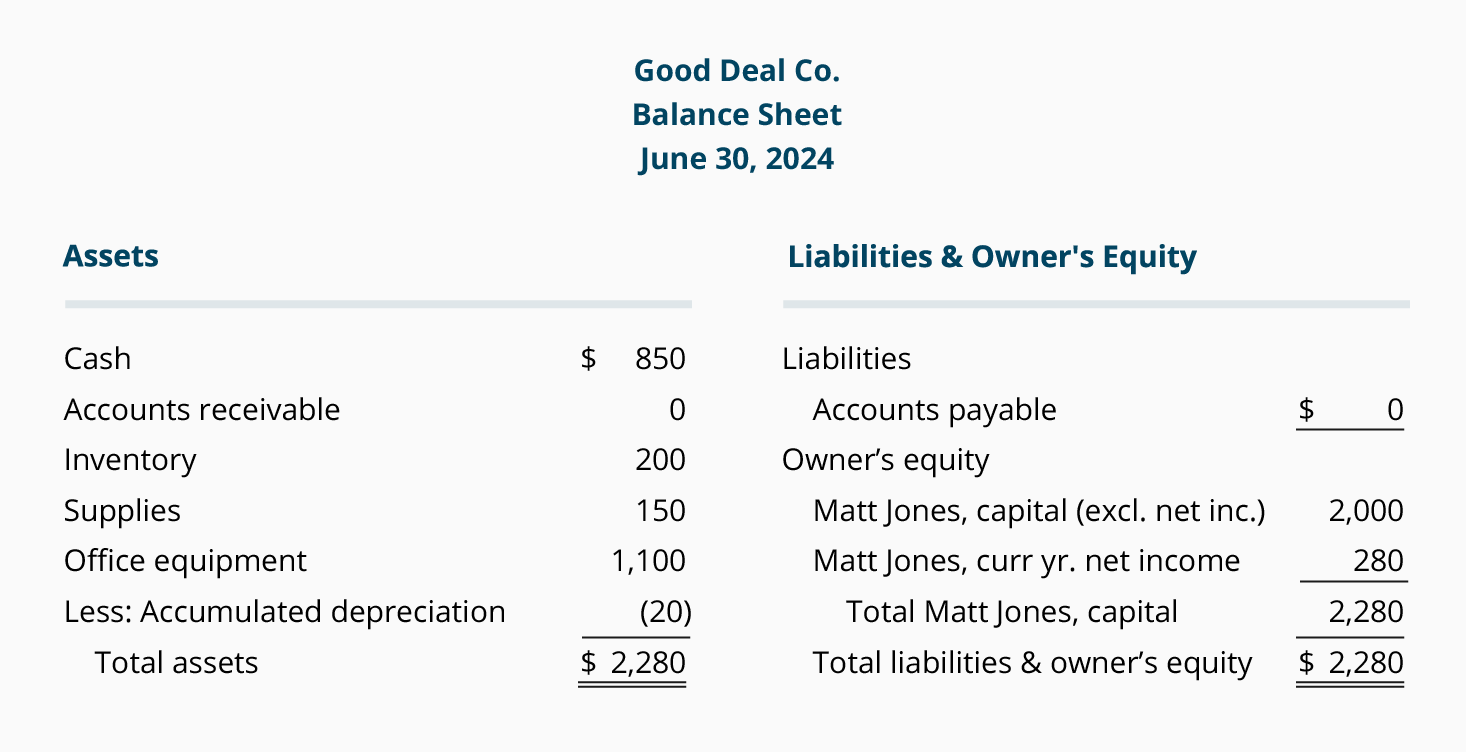

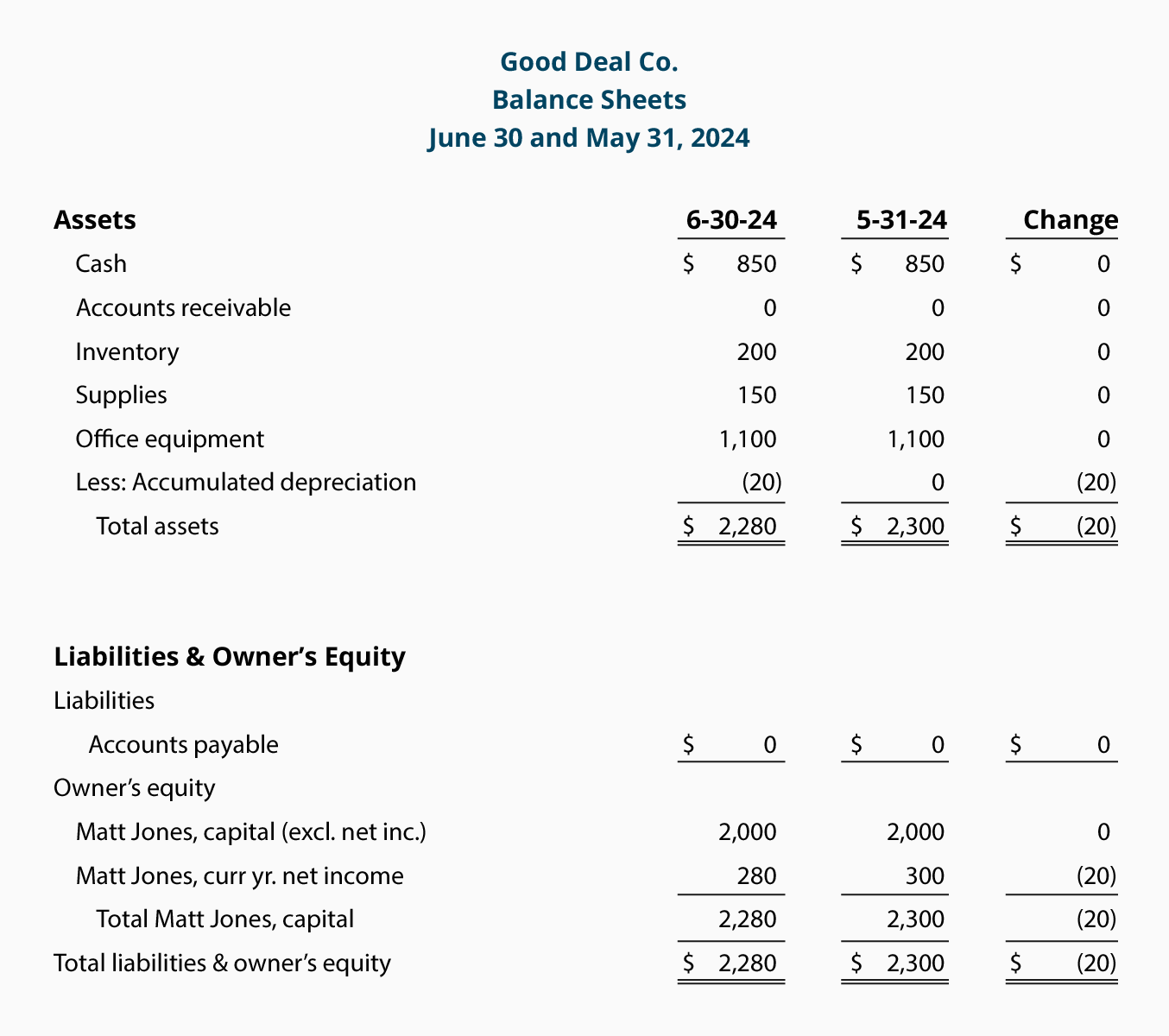

However the classified balance sheet focuses on representing the assets and liabilities in. The balance sheet formula is the accounting equation and it is the fundamental and most basic part of the accounting. Based on analyst research and management guidance we have completed the companys income statement projections including revenues operating expenses interest expense and taxes all the way down to the companys net income.

CFIs Financial Analysis Course. Accumulated depreciation recorded Accumulated Depreciation Recorded The accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date. The balance sheet is based on the fundamental equation.

Unlike a depreciation expense accumulated depreciation is a contra asset or asset credit balance account that is reported on a companys balance sheet. Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below. The balance sheet will form the building blocks for the whole double entry accounting system.

Examples of Balance Sheet Formula With Excel Template Balance Sheet Formula Calculator. Operating income Gross Profit Operating Expenses Depreciation Amortization. Investors business owners and accountants can use this information to give a book value to the business but it can be used for so much more.

The salvage value is Rs. An assets carrying value on the balance sheet is the difference between its purchase price. Formula for Operating income.

Also included is canceled currency held pending destruction and currency destroyed in late shift work on the balance sheet date. Now let discuss how to calculate accumulated depreciation. The latter are determined by formula when credit is being taken for unfit currency that is destroyed and appropriate adjustment is made to Treasury general account.

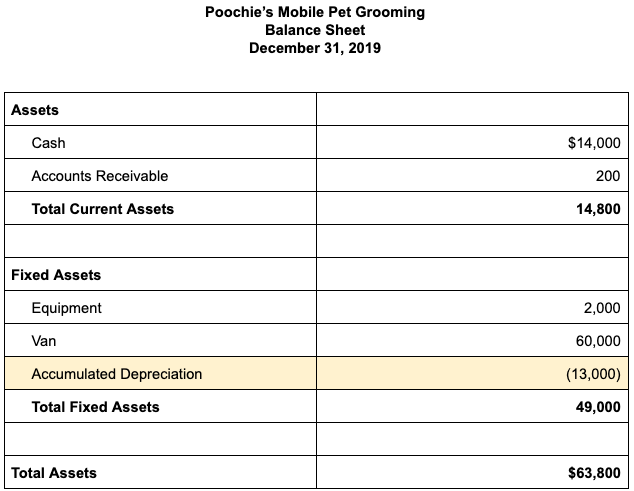

Balance sheet projections exercise. Owns machinery with a gross value of 10 million. Depreciation expenses vs accumulated depreciation.

Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. The balance sheet displays the companys total assets and how the assets are financed either through either debt or equity. Cr_Accumulated depreciation 40000 BS Total accumulated depreciation expenses at the end of 31 December 2019 is USD440000.

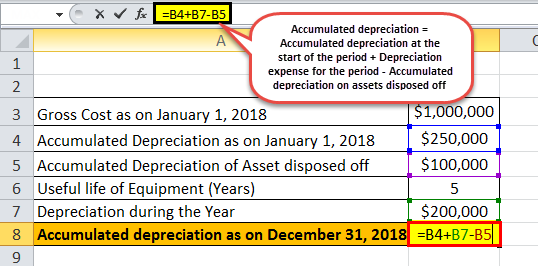

Accumulated depreciation is used to calculate an assets net book value which is the value of an asset carried on the balance sheet. The purpose of a balance sheet. Figure out the assets accumulated depreciation at the end of the last reporting period.

How Accumulated Depreciation Works. Using the formula for accumulated depreciation the calculation for year 2 with the values filled in is. This is expected to have 5 useful life years.

Accumulated depreciation is. A companys balance sheet represents its financial health and position of it at a given time. 1026 Federal Reserve NotesIn Transit 210-075.

Imagine that we are tasked with building a 3-statement statement model for Apple. On April 1 2012 company X purchased a piece of equipment for Rs. There are three formulas to calculate income from operations.

Fixed Assets In The. So the accumulated depreciation for year 1 is 10000. Generally a balance sheet is presently based on the accounting equation.

Operating income Total Revenue Direct Costs Indirect Costs. Company X considers depreciation expenses for the nearest whole month. Accumulated depreciation on 31 December 2019 is equal to the opening balance amount of USD400000 plus depreciation charge during the year amount USD40000.

Because the balance sheet reflects every transaction since your company started it reveals your businesss overall financial health. Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time. The formula for net book value is cost an asset minus.

It is a contra-account the difference between the assets purchase price and its carrying value on. Read more ie an asset account having the credit. It represents the assets owned by a business entity liabilities owed and the businesss equity.

The declining value of the asset on the balance sheet is reflected on the income statement as a depreciation expense.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition And Why It Is Important Fincent

Accumulated Depreciation Definition Formula Calculation

This Balance Sheet Template Allows Year Over Year Comparison Including Accumulated Depreciation Balance Sheet Template Balance Sheet Cash Flow Statement

Depreciation Expense Depreciation Expense Accountingcoach

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Formula Examples With Excel Template

Depreciation Expense Depreciation Expense Accountingcoach

How Is Accumulated Depreciation Represented In The Balance Sheet As A Negative Credit Asset Or As A Positive Debit Liability Quora

Accumulated Depreciation Calculation Journal Entry Accountinguide

Depreciation Formula Examples With Excel Template

Realtimme Cloud Solutions Helpfile

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Overview How It Works Example

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Balance Sheet Long Term Assets Accountingcoach

Reducing Balance Depreciation Calculator Double Entry Bookkeeping